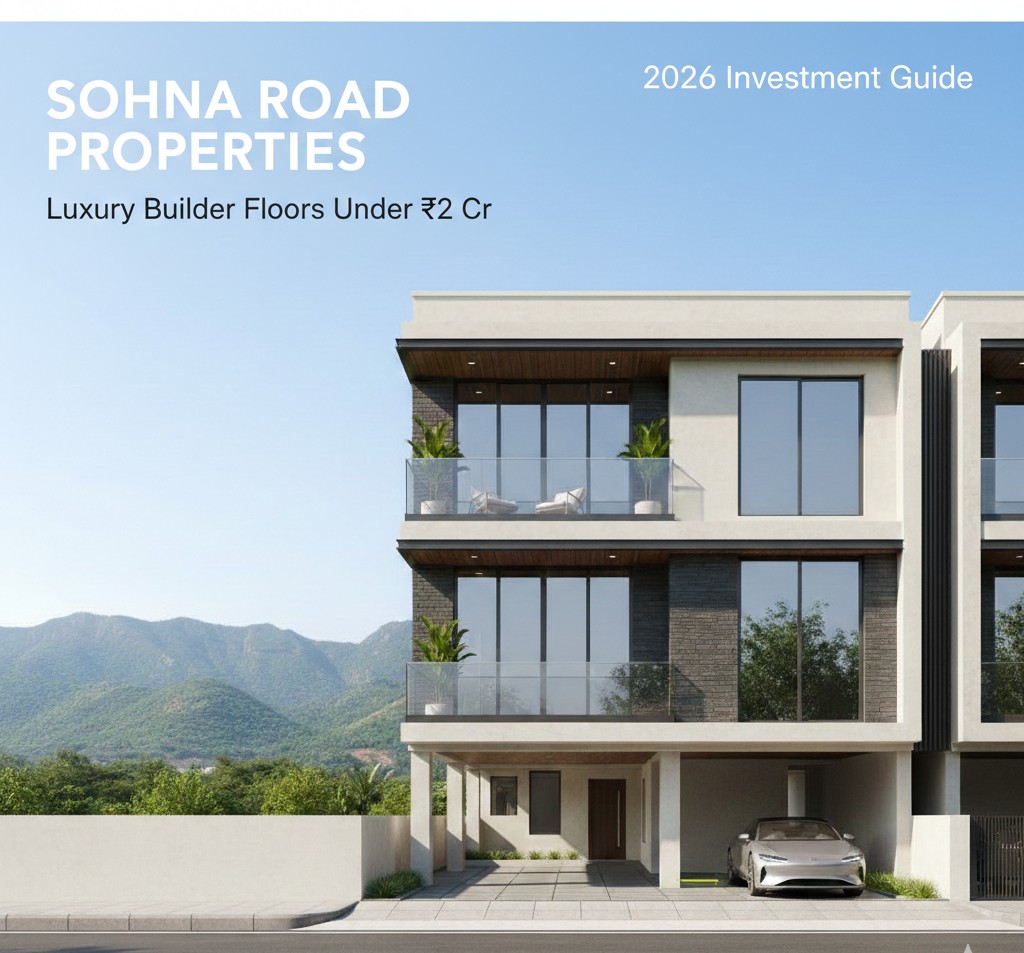

High-Rise Saturation vs. Low-Rise Growth: Why Breez Polo Reserve Sector 33 is the #1 Investment Hack in 2026.

Investors in Delhi-NCR are noticing a trend: Sohna builder floors are delivering higher rental yields (approx. 4.5%) compared to the 2.5% seen on Golf Course Extension Road. Here is why Breez Polo Reserve is the top-picked bookmark this week:

Asset Ownership: Unlike high-rises, you get a significant Undivided Share of Land (UDS).

The 30:70 Advantage: A flexible 2026 payment plan that makes premium 3 BHK & 3.5 BHK ownership easier.

Ready-to-Use Alpha: Don't wait for "upcoming" amenities. The grand clubhouse, rooftop infinity pool, and the cafe circuit are already operational.

Capital Growth: Sector 33 has seen an 11.2% Y-o-Y price rise, with average rates now hitting ₹11,480/sq. ft.

Investor Guide: [Check Prices & ROI Analysis - Breez Polo Reserve] https://sohnabuilderfloors.com..../polo-reserve-builde #realestate #poloreserve